Principles to Find and Profit from Wealth Winners® — Part 1

By John Price

“Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

Warren Buffett

Warren Buffett often says you don’t need a high IQ to be a successful investor. What he does say, though, is you need character and temperament. You need to be clear about the principles you are going to employ and have the temperament to stick with them.

There are two problems here and this is where it becomes interesting. The first is most investors, analysts, and fund managers don’t have a clear idea of which principles are going to be most successful over time. The second is when things don’t go as smoothly as hoped in the short term, they start experimenting with other principles. Of course, this experimentation is done with the best of intentions. Nevertheless, over time they often completely change their investing methods in a desperate struggle to avoid unsatisfactory results.

These changes can be subtle. Consider phrases I read in the report of a well-known fund. The managers wrote: “The price of XYZ pulled back its losses from the previous quarter.” And: “The price of ABC broke through the $10.00 barrier.”

Phrases such as these seem innocuous. The problem is in a subtle way they encourage you to think of share prices as having a life of their own with emotions and feelings instead of their being outcomes of the success of the underlying businesses. It is the ultimate anthropomorphism or act of agency. The result is investing is seen as a battle between the investor and a mythical being called the share price. Confusion dominates with hope for gamblers’ luck always at the back of investors’ minds.

Teaminvest General Investing Principles

To make the principles more accessible, I have divided them into three separate articles referred to as Parts 1, 2, and 3. Part 1 focusses on principles associated directly with the beliefs and activities of investors. The next article, Part 2, will focus on the board and company processes, and the final article, Part 3, will focus on the products and services of the companies.

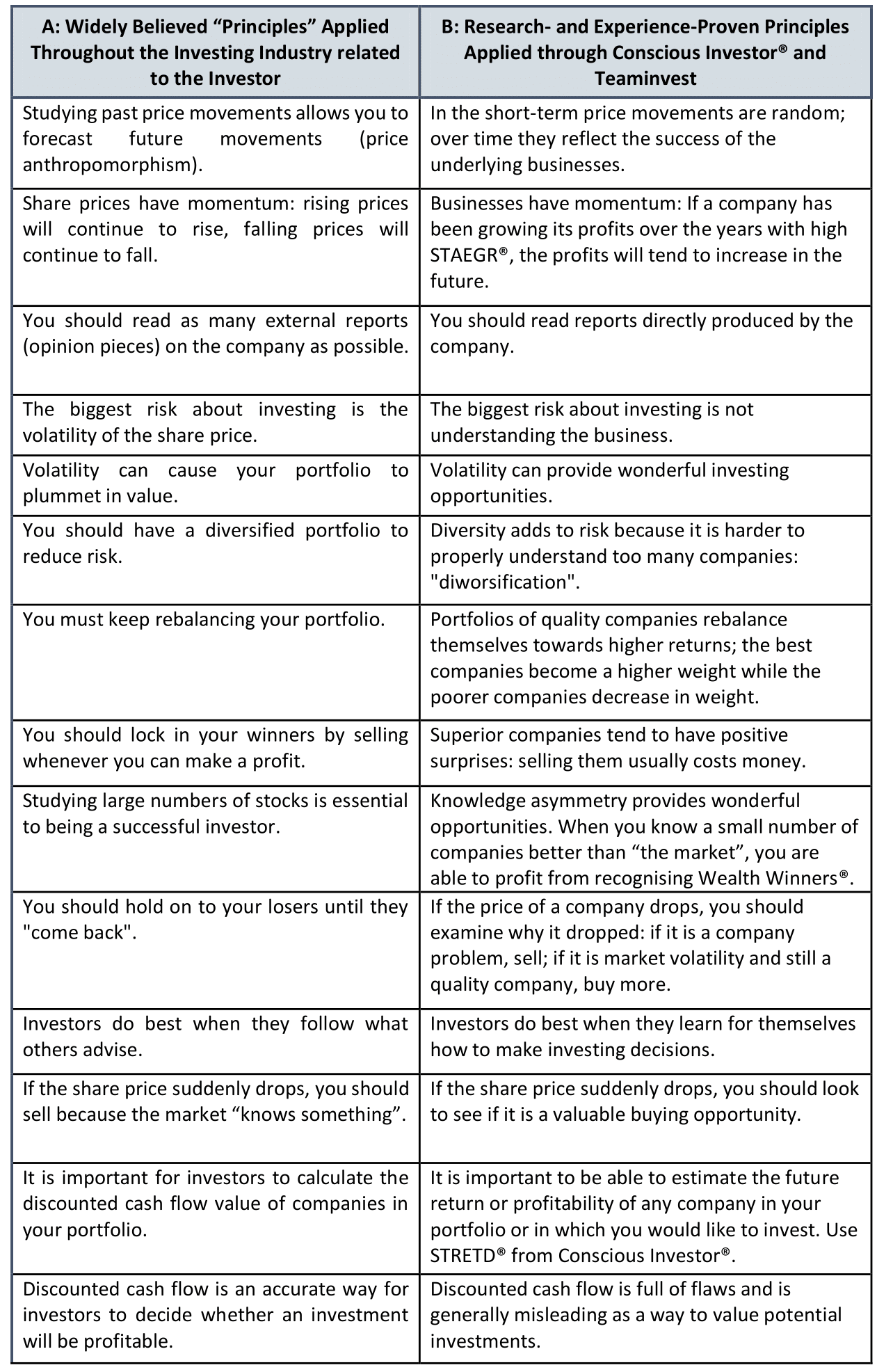

In the table in each Part, Column A lists common principles that investors widely believe, whether amateurs or professional. (Of course, if they are only believed without proper research and experience to validate them, they are not really principles, at best they’re only dogmas.)

Side by side in Column B I list the principles used in Conscious Investor®, Teaminvest, and the Conscious Investor® Fund. These principles have been proven by research and verified by experience. In some cases, the proven principles are modifications of the first principle, in others, they are the complete opposite. For instance, a standard belief is that you should always lock in your profits. Yet more success comes from the opposite, holding on to wonderful companies. As Peter Lynch said, it is better to water the flowers and remove the weeds rather than the other way around.

The Conscious Investor Fund

These principles are core to consistent successful investing. But they are not just for individual investors. They are also core for stock selection for managed funds to be consistently successful. For this reason, they are central to the selection process in our Conscious Investor Fund.

Are you ready to take the next step?

The fund is designed for people who are not interested in or who are unable to manage their own share investments. However, If you are interested in learning how to manage your own share portfolio and getting better returns the Teaminvest way, then we’d love to speak to you.

To find out if Teaminvest is right for you and if you would be a good fit for Teaminvest, book a call with our long-time member, Chris, here.

The principles described in Column B are part of the intellectual property of Conscious Investor®, Teaminvest, and the Conscious Investor® Fund.

Conscious Investor® is a registered trade mark in the US and Australia. Other trade marks used on this site and in Conscious Investor include Capital Killers™ and Wealth Winners®. All trade marks are used under license.

This article contains general investment advice only (under AFSL 334339). Authorised by Mark Moreland.